Why Buying a Fixer Upper Rental Property Can Build Serious Wealth

Buying a fixer upper rental property is a powerful way to build wealth in real estate. These homes often sell for 8% less than market value, allowing smart investors to create instant equity while generating steady rental income.

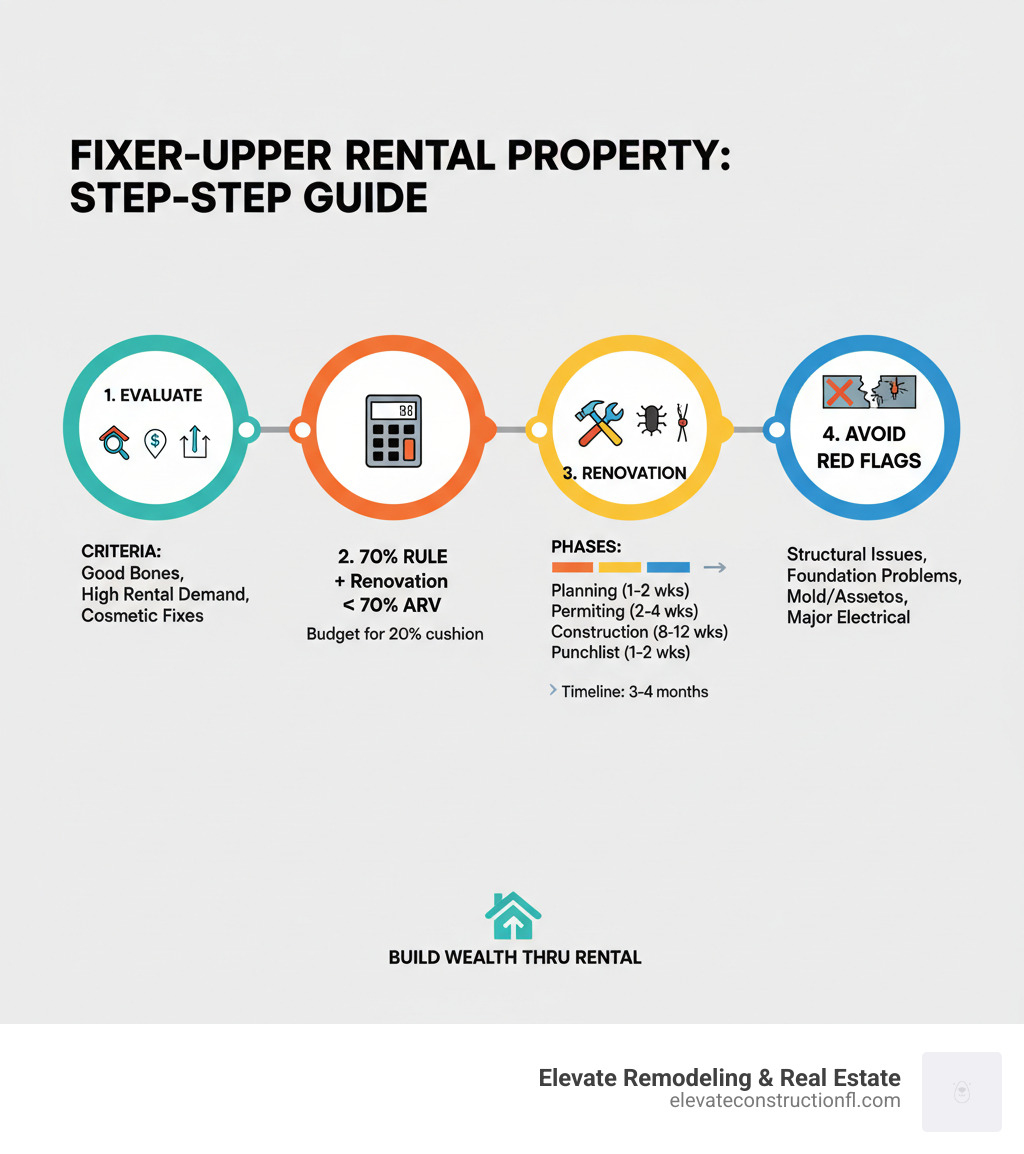

Heres what you need to know for success:

Key Success Factors:

- The 70% Rule: Your purchase price plus renovation costs shouldn’t exceed 70% of the property’s After-Repair Value (ARV).

- Budget for surprises: Add a 20% contingency to your renovation budget for unexpected costs.

- Focus on cosmetic issues: Prioritize properties that need cosmetic updates over those with major structural or foundation problems.

- Location is key: Buy in areas with strong rental demand and good schools.

Common Renovation Costs to Expect:

- Electrical system updates: ~$20,000 for a 2,000 sq ft home

- Foundation repairs: $2,000-$7,500

- Mold remediation: $1,125-$3,439

- Asbestos removal: $1,200-$3,100

The BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat) has made many investors wealthy, but it requires careful planning. The biggest advantage is facing less competition, as most buyers prefer move-in ready homes. This allows you to secure better deals on properties that just need some TLC.

At Lift Remodeling & Real Estate, we’ve seen how buying a fixer upper rental property can transform an investor’s portfolio. Our experience in construction and real estate confirms that success hinges on thorough due diligence, realistic budgeting, and knowing when to walk away from a bad deal.

Foundations: Is a Fixer-Upper Rental Right for You?

A fixer-upper rental property is a home that needs work before it’s tenant-ready, ranging from cosmetic updates to major system overhauls. These properties typically have a lower purchase price that reflects the required investment in renovations.

Buying a fixer upper rental property is about creating value through smart improvements. At Lift Remodeling & Real Estate, we see these properties as diamonds in the rough, especially in Tampa Bay’s competitive market.

Before you dive in, honestly assess if this strategy fits your life. Consider the time commitment for managing a project, your financial readiness for unexpected costs, and your personal capacity for stress when things go wrong. The risk versus reward is different for everyone; it’s about knowing yourself and your goals.

The Pros: Building Instant Equity and Cash Flow

The advantages of buying a fixer upper rental property are compelling for investors seeking to maximize returns.

- Lower Purchase Price & Less Competition: Fixer-uppers sell for about 8% less than market value. You’ll face fewer bidding wars as most buyers want move-in ready homes.

- Forced Appreciation & Higher ROI: Instead of waiting for the market to rise, you actively increase the property’s value through renovations, often leading to a higher return on investment.

- Strong Cash Flow Potential: A lower purchase price can mean a smaller mortgage. After renovating, you can command higher rents, creating healthy monthly income.

- Customization: You control the design and finishes, allowing you to create a property that stands out and appeals to your target renters.

- Tax Benefits: Your initial property taxes are based on the lower purchase price. Renovation costs can also provide significant tax deductions and increase your property’s depreciation basis.

The Cons: Navigating Potential Pitfalls and Hidden Costs

Be prepared for the realities of renovating. Buying a fixer upper rental property comes with potential challenges.

- Unexpected Repairs: The biggest budget killer. You might plan for new cabinets but find the entire electrical system needs replacing (~$20,000) or the foundation needs work ($2,000-$7,500). Mold remediation ($1,125+) and asbestos removal ($1,200+) are other common costly surprises.

- Budget Overruns: It’s wise to add a 20% contingency fund to your renovation budget. First-time investors often see costs increase by 25% or more.

- Time Delays & Stress: A two-month project can easily stretch to four or five due to permit delays or contractor issues. Meanwhile, you’re paying holding costs on a vacant property.

- Major Issues: Serious structural problems, lead paint, or widespread asbestos can turn your investment into a nightmare, creating expensive and dangerous situations.

For a deeper dive, research the possible hidden costs of a fixer-upper to understand what might be lurking behind the walls.

The Due Diligence Playbook for Buying a Fixer Upper Rental Property

Buying a fixer upper rental property without proper due diligence is a recipe for disaster. This stage is about digging into the numbers and the neighborhood to ensure you’re not buying a money pit.

At Lift Remodeling & Real Estate, we’ve seen investors get burned by skipping this step. Thorough market analysis and property evaluation are your best protection. For more on how we assist with property evaluation, explore our real estate services.

Location, Location, Renovation: Analyzing the Neighborhood

The best renovation won’t save a property in a bad location. Here’s what to analyze:

- Rental Demand: Are people actively looking to rent here? High demand means less vacancy.

- School Districts: Good schools attract stable, long-term tenants and support property values.

- Local Amenities: Tenants seek proximity to stores, parks, public transport, and jobs.

- Neighborhood Comps: What are similar renovated homes renting for and selling for? This data is crucial for your ARV and income projections.

- Future Development: Is the city investing in new infrastructure? Are employers moving in or out?

Remember the golden rule: buy the worst house on the best block.

The Critical Role of a Home Inspection

Never skip a professional inspection on a fixer-upper. A qualified inspector is your financial bodyguard, checking for costly issues.

- Structural Integrity: Foundation problems can cost tens of thousands to fix.

- Roof Condition: A new roof is a major expense, and leaks cause widespread damage.

- HVAC, Plumbing, and Electrical: Outdated systems are expensive to replace and can be unsafe. Bringing an old electrical system up to code can cost $20,000. We recommend a sewer line scope to check for hidden plumbing issues.

Find a qualified inspector through the American Society of Home Inspectors (ASHI) or trusted local referrals.

Accurately Estimating Renovation Costs

Underestimating renovation costs is the fastest way to lose money. Start with a detailed scope of work and get at least three quotes from licensed contractors for major jobs. Remember to factor in material costs and permit fees.

Most importantly, always budget an additional 20% for unexpected expenses. Surprises are inevitable, especially in homes over 50 years old. For help with planning and estimating, our team offers comprehensive remodeling construction services.

Red Flags: When to Walk Away from a Deal

Knowing when to walk away is a critical skill. Be cautious of these deal-breakers:

- Severe foundation or structural damage

- Widespread mold or asbestos

- Layouts requiring major structural changes

- Unfavorable zoning or unresolvable title issues

- Environmental hazards like contaminated soil

If the numbers don’t workespecially if the total cost exceeds 70% of the ARVit’s time to find another deal.

Securing the Deal: Financing and Purchasing Your Fixer-Upper

Once you’ve found your property, it’s time to secure the deal. The financing and purchase process for a fixer-upper has unique challenges, as traditional lenders can be wary of properties needing significant work. Understanding your options is crucial for buying a fixer upper rental property successfully.

For comprehensive support, including specialized funding solutions, explore our loans and funding services.

Financing Options for Buying a Fixer Upper Rental Property

Several loan programs are designed for properties that need renovation, bundling the purchase price and repair costs into one loan.

- FHA 203(k) Loan: A popular government-backed loan, but it’s primarily for owner-occupants.

- Fannie Mae HomeStyle & Freddie Mac CHOICERenovation: These are excellent for investors, offering flexibility for various improvements. They work for investment properties, second homes, and primary residences.

- VA Renovation Loan: A great option for veterans and service members, requiring no down payment.

- Conventional Mortgages: Can work for properties needing only cosmetic updates.

At Lift Remodeling & Real Estate, we understand every investor’s situation is unique. We encourage you to inquire about our in-house financing and funding solutions for options custom to your goals in the Tampa Bay market.

Making a Smart Offer and Navigating the Purchase

A smart offer protects you and ensures the deal makes financial sense. Your starting point is calculating the After-Repair Value (ARV)what the property will be worth once renovated.

Next, apply the 70% Rule. Your total investment (purchase price + renovation costs) should not exceed 70% of the ARV. For example, if the ARV is $300,000 and renovations will cost $80,000, your maximum offer should be $130,000 ($300,000 x 0.70 – $80,000). This 30% buffer covers holding costs, fees, and your profit.

Always include an inspection clause and an appraisal clause in your offer to protect yourself. Working with a real estate agent experienced in investment properties is also invaluable.

Tax Implications and Potential Savings

Buying a fixer upper rental property comes with significant tax benefits that can boost your returns.

- Property Tax Assessment: Your initial taxes will be based on the lower purchase price, helping cash flow during the renovation.

- Depreciation: The IRS allows you to depreciate the property cost and capital improvements over 27.5 years for residential rentals. This creates a “paper loss” that can reduce your taxable income.

- Capital Expenditures vs. Repairs: Major improvements (capital expenditures) are depreciated over time, while routine repairs can often be expensed in the current year for an immediate tax benefit.

Always consult a tax professional to create a strategy that fits your specific situation.

The Renovation Playbook: From Rehab to Rent-Ready

You’ve secured the propertynow the hard work begins. The renovation phase turns your vision into a profitable rental property. Effective project management is key to keeping the project on time and on budget.

At Lift Remodeling & Real Estate, we guide Tampa Bay investors through this complex process. For insights into our approach, learn about our construction management services.

DIY vs. Hiring Professionals: Making the Right Choice

Deciding whether to DIY or hire a pro depends on your skills, time, and budget.

- DIY: Can save on labor costs but often takes much longer. It’s best for cosmetic tasks like painting or simple landscaping if you have the skills. Be realistic about your abilities and the time required.

- Hiring Professionals: Costs more upfront but usually results in faster, higher-quality work. For major structural, electrical, plumbing, or HVAC work, we strongly recommend hiring licensed and insured professionals. Mistakes in these areas are dangerous and expensive to fix.

Creating a Strategic Project Timeline

A structured timeline is your roadmap. A phased approach works best for buying a fixer upper rental property and renovating it.

- Structural & Exterior: Start with the foundation, roof, siding, and windows to protect the structure.

- Systems: Tackle plumbing, electrical, and HVAC while the walls are open.

- Interior Rough-ins: Install insulation and drywall.

- Finishes: Focus on high-impact areas like kitchens and bathrooms, then install flooring.

- Final Touches: Complete painting, trim, and final fixtures.

Clear communication with contractors and pulling all necessary permits before work begins are crucial for avoiding delays and fines.

From Project to Profit: Managing Your Renovated Rental

Once renovations are complete, it’s time to turn your property into an income stream.

- Marketing: Use high-quality photos to showcase your renovations.

- Tenant Screening: Conduct thorough background, credit, and employment checks to find reliable tenants.

- Set Competitive Rent: Research local comps to find the right rental price.

- Use a Solid Lease: A comprehensive lease agreement protects you and your tenant.

Many investors hire property management companies to handle these tasks. This allows you to focus on finding your next deal while ensuring your investment runs smoothly.

Frequently Asked Questions about Fixer-Upper Rentals

Here are answers to the most common questions we get from investors considering buying a fixer upper rental property in the Tampa Bay area.

How much of a fixer-upper is too much to handle?

This depends on your budget, timeline, and expertise. For most investors, especially beginners, it’s wise to avoid properties with:

- Major structural or foundation problems: These repairs can be unpredictable and extremely expensive, sometimes costing $50,000 or more.

- Widespread environmental hazards: Extensive mold or asbestos requires costly, specialized remediation.

- Need for complete reconstruction: Gut renovations or moving load-bearing walls add significant complexity and cost.

Stick to cosmetic updates and manageable repairs until you have more experience. If repair costs are unpredictable, it’s likely too much to handle.

How do you calculate if a fixer-upper rental is a good deal?

We always recommend the 70% Rule. This formula ensures your deal is financially sound. It states that your total investment (purchase price + estimated renovation costs) should not exceed 70% of the property’s After-Repair Value (ARV).

For example: If a property’s ARV is $300,000 and you estimate $50,000 in renovations, your maximum purchase price should be $160,000 ($300,000 x 0.70 – $50,000).

This 30% buffer covers holding costs, unexpected expenses, closing costs, and your profit margin. Sticking to this rule keeps emotions in check and protects your investment.

Can I use a renovation loan for an investment property?

Yes, absolutely! While some programs like the FHA 203(k) are mainly for owner-occupants, there are excellent renovation loans for investors.

The Fannie Mae HomeStyle Renovation Mortgage is a great example. It allows you to finance the purchase and renovation costs in a single loan for a rental property. These loans require more documentation, such as detailed contractor estimates, but the convenience is often worth it.

At Lift Remodeling & Real Estate, we understand these financing options. Contact Lift Remodeling & Real Estate to learn more about financing solutions that can help you purchase and renovate your next rental property in the Tampa Bay area.

Conclusion: Transform Your Investment Portfolio with a Smart Renovation

Buying a fixer upper rental property is a powerful strategy for creating value, building equity, and generating monthly income. The key is mitigating risk through smart decisions.

Success comes from a discounted purchase price, less competition, and the ability to customize a property for maximum rental appeal. However, you must be prepared for potential challenges like hidden costs and project delays. This is why thorough due diligence is non-negotiable. A comprehensive inspection, accurate cost estimates with a 20% contingency, and deep neighborhood knowledge are your financial lifelines.

The 70% rule is the guiding principle that builds a safety margin into your investment, separating profitable projects from cautionary tales.

What sets successful investors apart is having the right team. At Lift Remodeling & Real Estate, we know that buying a fixer upper rental property requires expertise in real estate, construction, and finance. Our all-in-one approach provides transformative renovations, comprehensive real estate services, and project funding options, all from an expert team that understands the Tampa Bay market.

You’re not just buying a property; you’re building a foundation for long-term wealth.

Ready to find and transform your next Tampa Bay investment property? Contact our team today! We’re ready to help you lift your investment portfolio.