Understanding the $5.1 Trillion Real Estate Investment Industry

Investment company real estate represents one of the world’s largest and most sophisticated financial sectors, where specialized firms pool investor capital to acquire, manage, and develop properties across the globe. Here’s what you need to know:

Key Facts About Real Estate Investment Companies:

- Scale: Global real estate managers hold more than $5.1 trillion in assets under management

- Leaders: Top firms like Blackstone ($602 billion AUM) and Brookfield ($277 billion AUM) dominate the market

- Strategy: They generate returns through rental income, property appreciation, and strategic repositioning

- Access: Provide individual investors entry to institutional-grade real estate deals

- Diversification: Invest across multiple asset classes including residential, industrial, office, and retail properties

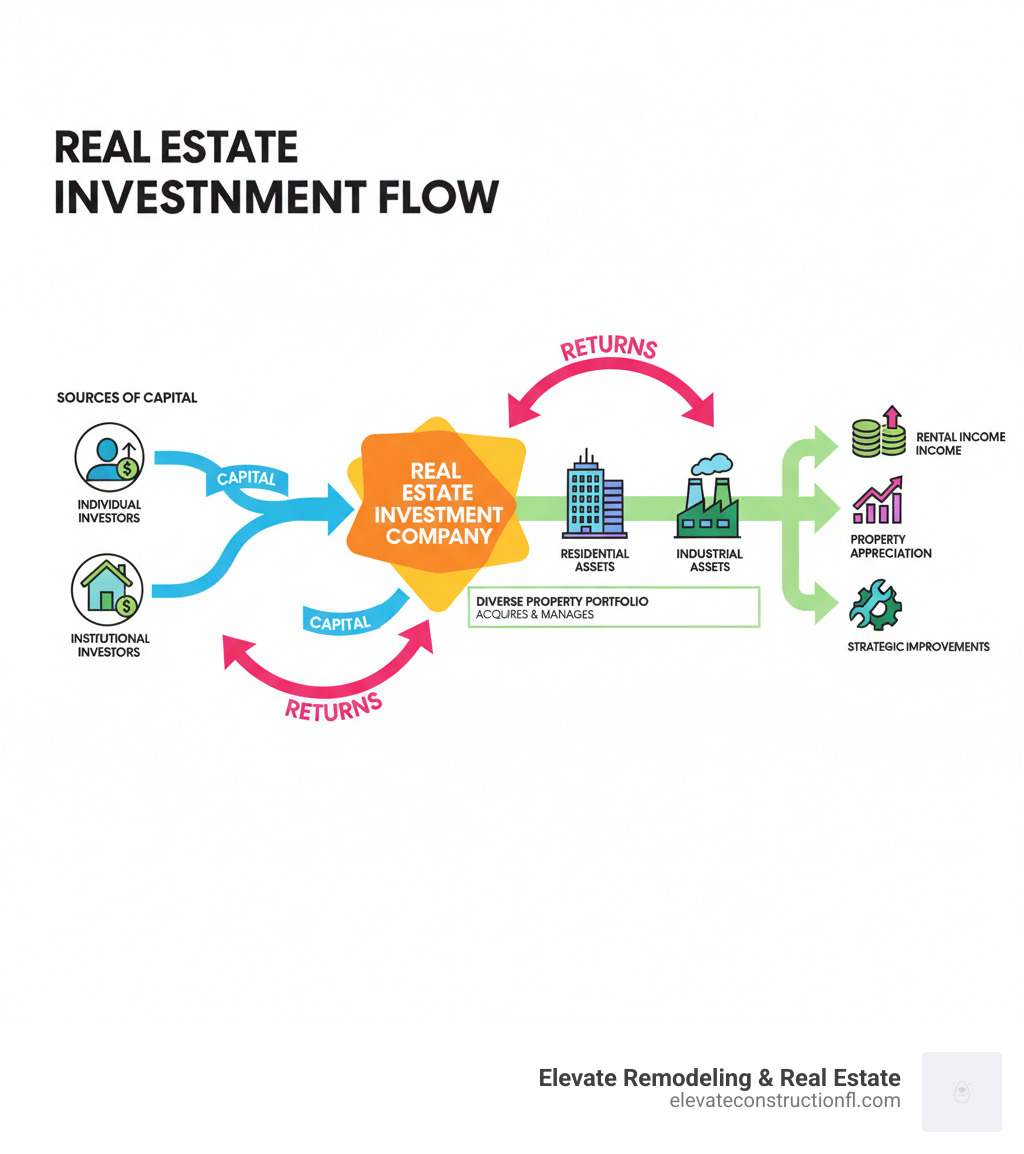

These companies serve as intermediaries between investors seeking real estate exposure and the complex world of property acquisition and management. They leverage professional expertise, market research, and significant capital to identify opportunities that individual investors typically cannot access on their own.

The industry has evolved dramatically, with firms now employing sophisticated strategies ranging from stable, income-focused investments to high-risk, high-reward development projects. Major players actively adapt to global trends like e-commerce growth, which has made logistics warehouses highly sought-after assets.

With hands-on experience in property development and client relations at Lift Remodeling & Real Estate, we’ve seen how investment company real estate strategies translate into real-world property changes and value creation. Our background in construction management and real estate operations provides unique insight into how these large-scale investment principles apply to individual property investors and developers.

What is a Real Estate Investment Company?

A real estate investment company is your gateway to large-scale property investing. These firms have one clear mission: acquiring and managing properties to generate solid returns for their investors. They act as experienced captains navigating the sometimes choppy waters of real estate markets on your behalf.

These companies pool money from various investors—from large pension funds to high-net-worth individuals. They use this combined buying power to acquire properties that would be out of reach for most solo investors.

Global real estate managers hold over $5.1 trillion in AUM, with the largest firms managing hundreds of billions each. This scale allows them to make moves that can reshape entire neighborhoods or even cities.

This massive scale gives investors access to institutional-grade properties. These are top-tier buildings—professionally managed, strategically located, and typically too expensive for individual buyers. The investment companies transform these complex, high-value assets into manageable investment opportunities.

The Structure: Private Real Estate vs. Public Real Estate Investment Options

When looking at investment company real estate options, you’ll find two main paths that work very differently.

| Feature | Private Real Estate Investing | Public Real Estate Investment Options (e.g., REITs) |

|---|---|---|

| Accessibility | Typically for accredited investors, institutions, and high-net-worth individuals. | Accessible to all investors via stock exchanges. |

| Liquidity | Low; investments are illiquid with long holding periods (years). | High; shares can be bought and sold daily on stock exchanges. |

| Transparency | Limited; less frequent reporting, private valuations. | High; subject to SEC regulations, frequent public reporting. |

| Valuation | Appraised periodically, less susceptible to daily market swings. | Valued daily by the stock market, subject to volatility. |

| Investment Horizon | Longer term (5-10+ years), focused on long-term appreciation and income. | Shorter to medium term, can be traded based on market sentiment. |

| Management Control | Investors often have less direct control, relying on the firm’s expertise. | No direct control over property management; invest in a portfolio managed by others. |

| Correlation to Stocks | Lower correlation to public stock markets, offering diversification. | Higher correlation to public stock markets due to trading on exchanges. |

| Minimum Investment | High, often hundreds of thousands or millions. | Low, can invest with a few hundred dollars. |

| “Illiquidity Premium” | Potential for higher returns to compensate for lack of liquidity. | No illiquidity premium, as investments are highly liquid. |

Private real estate investing offers direct ownership in properties but requires significant capital and is typically for accredited investors. These investments have longer horizons (5-10+ years) and offer an illiquidity premium—higher potential returns to compensate for the inability to cash out quickly.

Public real estate options, like REITs, trade like stocks. They are highly liquid, accessible with small investments, and provide daily valuation. However, they are subject to market volatility and correlate more closely with the stock market.

The Role of an Investment Company in Real Estate

So why partner with an investment company real estate firm instead of going it alone? The benefits are compelling.

Pooling capital is the first big advantage. By combining funds, investors can afford high-value properties like a $50 million office building, which would be unattainable alone.

Professional management is another key benefit. These firms provide teams of experts—from market analysts to property managers—who handle every aspect of the investment. You gain access to their expertise without needing to manage the properties yourself.

Access to deals is a major perk. These companies often get access to off-market properties through their extensive networks and reputation, opening doors unavailable to individual investors.

Diversification is perhaps the most crucial benefit. Firms spread investments across various property types and locations, reducing risk. A diversified portfolio can weather downturns in specific markets or sectors.

For anyone considering real estate investments alongside property improvements, understanding how these companies operate provides valuable context. More info about real estate services can help you explore comprehensive approaches to property investment and development.

How an Investment Company Real Estate Creates Value

Investment company real estate firms act like master chefs, carefully selecting properties and applying their expertise to transform them into more valuable assets.

Value is created in two main ways of generating returns. First, rental income provides a steady cash flow from tenants in residential, commercial, or industrial properties. This reliable income stream is a foundational component of real estate returns.

Second, capital appreciation increases a property’s value over time. This isn’t passive; firms actively boost value through strategic improvements, superior management, and repositioning the asset in the market.

Real estate investment horizons are typically long-term, ranging from 5-10 years or more, unlike short-term stock trading. This focus on long-term value creation sets successful firms apart, as they build portfolios designed to weather market shifts and produce wealth for years to come.

Core Investment Strategies Explained

Investment company real estate firms use different strategies, much like a toolbox with various tools for different jobs. Each approach balances risk and reward differently.

The core strategy focuses on high-quality, fully-rented properties in great locations. The goal is steady, predictable income with minimal surprises.

Core-plus strategy involves properties that may have some vacancies or need minor improvements, offering a balance of stable income and light value-add potential.

The value-add strategy is where firms acquire underperforming properties and invest significant capital and effort to transform them, open uping hidden potential.

Opportunistic strategy is the most adventurous, involving ground-up development or major redevelopment projects. These carry the highest risk but can also deliver the highest returns.

Some firms also use a debt strategy, lending money for real estate projects rather than owning properties directly. This approach earns steady interest payments backed by real estate.

The Value-Add and Opportunistic Approach

Value-add and opportunistic strategies are about seeing potential where others see problems.

Acquiring undermanaged assets involves finding properties that are not performing to their potential, such as an outdated apartment complex or a half-empty office building. The goal is to identify hidden value.

Firms then apply their redevelopment expertise through renovations, adding amenities, or repurposing the space entirely. For example, an old warehouse could become loft apartments, or a struggling retail center could be redeveloped into a mixed-use hub.

Property improvement and repositioning assets require both vision and skill. At Lift Remodeling & Real Estate, we understand this process intimately. Our remodeling construction services help bring these ambitious visions to life for any property size.

The goal is always maximizing value. Improved properties attract better tenants and higher rents, leading to lower vacancy rates and increased income. This directly translates to a higher property valuation.

It’s a complex process that requires market knowledge, construction expertise, and excellent project management. When done right, these strategies can turn modest investments into impressive success stories.

The Foundation of Successful Real Estate Investing

Even the most brilliant strategies in investment company real estate would crumble without a solid foundation of rigorous analysis and proactive management. Successful investing starts with these fundamentals.

Real estate moves in market cycles, influenced by broader economic conditions like interest rates, job growth, and population shifts. These cycles create fluctuating periods of seller’s and buyer’s markets.

Smart investment companies anticipate these cycles by studying patterns and economic indicators, positioning their portfolios to mitigate risks and capitalize on opportunities.

Thorough due diligence is the backbone of smart investing. Combined with solid risk management practices, this careful examination helps firms avoid costly mistakes and identify hidden opportunities.

Often overlooked, real estate is a people business. Strong partner relationships with contractors, city planners, and tenants are critical for a project’s smooth execution and success.

The Critical Role of Market Research and Due Diligence

Before investing, a successful investment company real estate firm conducts months of careful research to distinguish a valuable opportunity from a potential loss.

Market analysis involves deep dives into rental comps, vacancy rates, and future supply. Firms analyze historical data to forecast trends and determine a property’s potential value.

Understanding economic trends and demographic shifts is crucial. For example, the rise of remote work prompted pivots to industrial properties for e-commerce, turning mediocre investments into stellar ones.

Property valuation by professional firms involves detailed financial modeling that projects future income and expenses. This analysis considers all variables, from capital expenditures to potential rent growth.

The legal checks phase is critical. Issues with zoning, environmental regulations, or property titles can derail an investment. Experienced firms know what red flags to look for.

This comprehensive approach to identifying opportunities is what separates the pros from the amateurs. They see potential where others see an old building, but only after verifying that potential through rigorous analysis.

How Firms Manage Risk and Adapt to Market Cycles

Even the best investors can’t predict the future, but they can prepare for it. Building a resilient portfolio is key to navigating market uncertainty.

Diversification by asset and geography is the first line of defense. Spreading investments across different property types (e.g., apartments in Florida, warehouses in Texas) helps stabilize the portfolio if one market stumbles.

Hedging strategies act as insurance policies for investors. These financial tools help protect returns from unexpected swings in interest rates or currency values, especially for international investments.

Firms stress test portfolios by asking tough “what-if” questions: What if we lose half our tenants? What if interest rates double? This helps identify and fix weaknesses before they become real problems.

Flexible financing is another key tool. Multiple capital sources and adaptable loan structures prevent firms from being cornered by market changes. For investors, understanding these options is valuable; exploring different approaches to project funding can provide insight into how successful projects get financed.

Finally, tenant relationship management is vital. Happy tenants stay longer, pay on time, and maintain properties better. Strong tenant relationships ensure steady income, especially during economic downturns.

Key Investment Areas and Modern Trends

The landscape of investment company real estate is constantly evolving, driven by global shifts, technological advancements, and a growing emphasis on sustainability. Understanding these key investment areas and emerging trends is crucial for navigating this dynamic sector.

At Lift Remodeling & Real Estate, we see how these macro trends create local opportunities. The properties attracting investment today differ significantly from a decade ago, reflecting changes in how we live, work, and shop.

The market adapts quickly. A once-adequate warehouse may now be obsolete if it can’t support modern automation. A prestigious office building might struggle without the flexibility today’s workforce demands.

Major Real Estate Asset Classes

Investment company real estate firms spread their capital across various property types, each with its own risk and return profile.

Residential properties are a portfolio cornerstone, including apartments, single-family rentals, and niches like student housing, which is a growing opportunity due to enrollment increases and housing shortages.

The industrial sector is booming. Logistics facilities and warehouses are in high demand, driven by e-commerce’s need for last-mile delivery centers. This has led to unprecedented investment in industrial real estate.

Office buildings are in a state of transition. The rise of remote work has forced owners to rethink office space, focusing on creating attractive, collaborative environments rather than just providing square footage.

Retail properties must evolve. While traditional malls struggle, experiential and necessity-based centers still attract investment by giving consumers a reason to shop in person.

The hospitality sector—hotels and resorts—is closely tied to economic cycles and travel patterns, making it a more volatile but potentially rewarding investment.

Niche sectors have also emerged, including data centers, life sciences facilities, medical offices, and self-storage, each offering unique opportunities for savvy investors.

How Global Trends, ESG, and Technology are Shaping the Future

Three major forces are reshaping how investment company real estate firms invest and operate: global economic shifts, environmental consciousness, and technological innovation.

E-commerce growth has fundamentally shifted real estate, creating explosive demand for warehouses. As one expert noted, “Trends move fast. To keep up, cities need warehouses closer to home.” This has made logistics properties a top global investment. Watch a video about warehouse demand.

The remote work impact has redefined office space. Modern investments focus on flexibility, collaboration, and amenities to entice employees back to the office. This shift requires capital but creates opportunities for innovative firms.

ESG (Environmental, Social, and Governance) factors are now essential. Investors demand properties that are environmentally friendly, socially responsible, and well-governed, fueling a boom in green buildings and sustainable development.

Sustainability also makes financial sense. Green buildings typically have lower operating costs, attract premium tenants and rents, and hold their value better as environmental regulations tighten.

PropTech and data analytics are revolutionizing property management and valuation. AI-powered analysis, smart building systems, and virtual tours are making real estate more efficient and data-driven.

These advances help property managers work more efficiently, provide better tenant experiences, and make more informed investment decisions. It’s about leveraging data and automation to maximize value while reducing operational headaches.

Conclusion: Your Path in Real Estate Investing

We’ve explored investment company real estate, from how firms manage over $5.1 trillion in assets to their strategies for creating value and adapting to a changing world.

These companies make complex real estate markets accessible. They offer professional management, access to exclusive deals, and essential diversification that helps protect and grow wealth over time.

These firms highlight the importance of combining strategic vision with careful execution. Success always comes down to understanding market dynamics and having the expertise to act on that knowledge.

The market continues to evolve rapidly. Global economic trends, changing work patterns, and the growing importance of ESG factors mean that adaptability isn’t just helpful—it’s essential. Technology is reshaping how properties are managed, while sustainability has become a must-have for many investors.

For property owners and investors looking to execute their own value-add strategies, the principles we’ve discussed apply on any scale. The same careful market research, strategic planning, and quality execution that drive billion-dollar portfolios can transform individual properties too.

That’s where partnering with an all-in-one firm like Lift Remodeling & Real Estate becomes invaluable. We understand these value creation principles intimately and can translate them into tangible results for your specific projects. Our integrated approach to remodeling, real estate services, and project funding means you get the comprehensive support that larger investment companies provide, but customized to your individual needs.

Whether you’re managing a large portfolio or a single property, the fundamentals of smart strategy, diligent execution, and deep market understanding remain the same. We’re here to help you steer your own path in real estate investing, bringing that same level of expertise and comprehensive service to every project.

Explore our comprehensive services and find how we can help you maximize your property’s potential today.