Why VA Home Loans for Fixer-Uppers Are Game-Changers

A VA home loan for fixer upper properties offers veterans a unique path to homeownership, combining purchase and renovation financing into a single, zero-down payment mortgage.

Key Benefits:

- 0% down payment required

- No mortgage insurance needed

- Finance up to $35,000-$50,000 in renovations

- Build instant equity through improvements

- Access homes that don’t meet standard VA requirements

Requirements:

- Must use VA-approved contractors (no DIY work)

- Property must be your primary residence

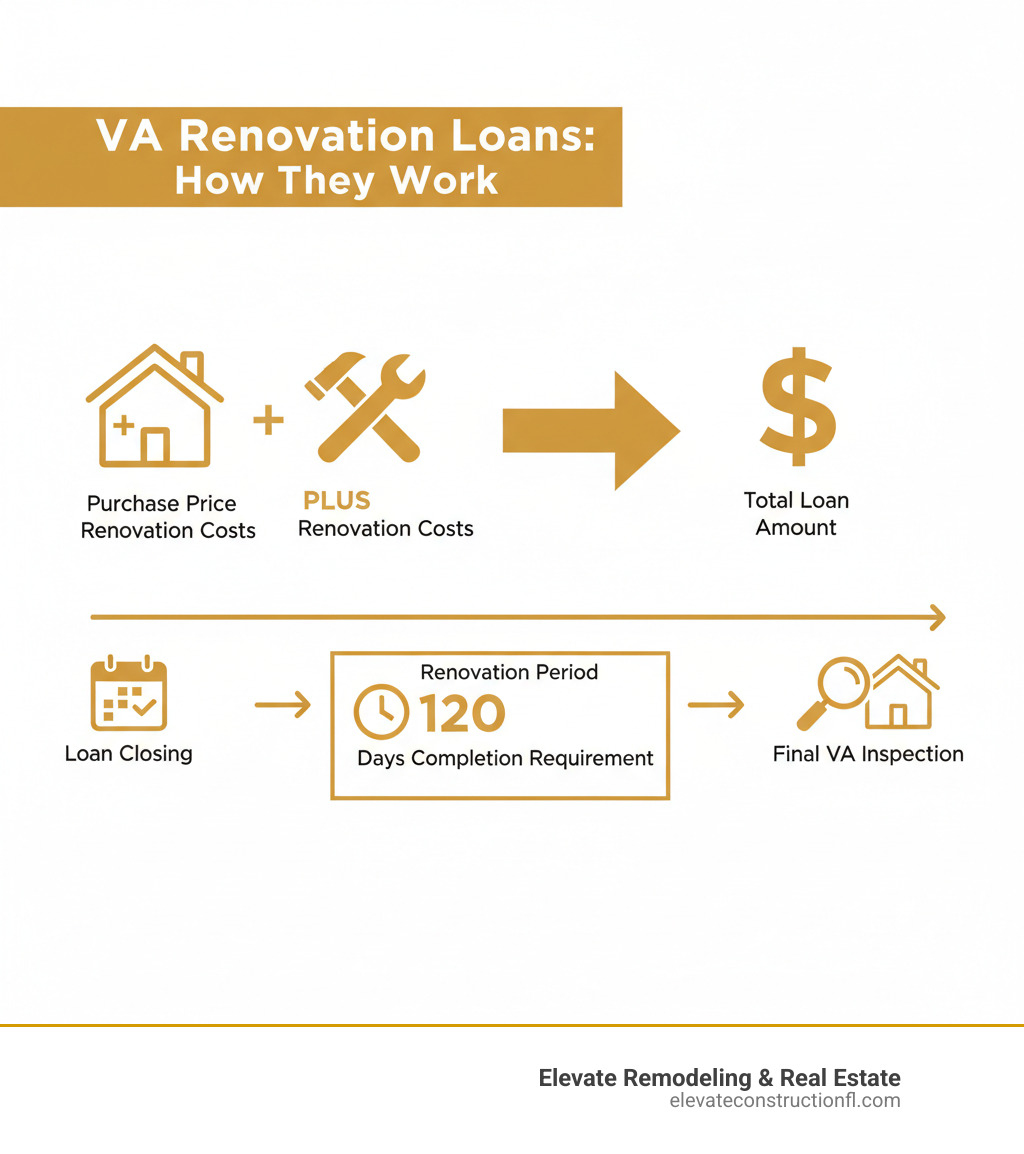

- Renovations must be completed within 90-120 days

- Focus on safety and livability improvements only

In a competitive housing market, fixer-uppers are a smart way for veterans to secure an affordable home they can customize. As one veteran shared in a recent forum discussion: “I bought a home built in 1880 with a VA loan and have been renovating it since.”

Also known as a VA rehab loan, this loan lets you borrow against the home’s future value after repairs. This means you can buy a property that doesn’t meet standard VA safety or habitability requirements and finance the necessary fixes.

I’m Johanna Cifuentes. At Elevate Remodeling & Real Estate, I’ve helped many clients, including veterans, steer the complexities of construction and real estate financing for VA home loan for fixer upper projects. My background in renovation and real estate provides unique insight into making these transactions successful.

Understanding the VA Home Loan for Fixer Upper Properties

For veterans struggling to find an affordable, move-in-ready home, the VA home loan for fixer upper properties is a game-changer. Also known as a VA rehab or alteration and repair loan, it’s designed to help veterans buy homes that need significant work to become safe, sound, and sanitary.

In 2018, the VA updated its guidelines, expanding opportunities for veterans to use their loan benefit on older homes needing repairs. This allows them to purchase or refinance a property in need of alteration with a VA renovation loan. You can review the official guidance at In 2018, the VA updated its guidelines.

The loan’s core principle is ensuring the home meets the VA’s Minimum Property Requirements (MPRs) for safety, soundness, and sanitation. The loan amount is based on the ‘as-completed value’—the home’s projected market value after renovations. This unique approach finances the purchase and improvements in one loan.

VA Renovation Loan vs. Traditional VA Loan

While both are backed by the Department of Veterans Affairs, a VA home loan for fixer upper (renovation loan) has distinct differences from a traditional VA purchase loan. Understanding these differences is key to determining which option is right for your homeownership goals.

| Feature | Standard VA Loan | VA Renovation Loan |

|---|---|---|

| Property Condition | Must meet Minimum Property Requirements (MPRs) before closing. | May not meet MPRs at the time of appraisal, but renovations financed by the loan will bring it up to standard after closing. |

| Funding for Repairs | Generally, no funds for repairs are included in the loan. Any necessary repairs must be completed by the seller or the buyer using separate funds prior to closing. | Finances both the purchase price and the cost of approved renovations into a single mortgage. |

| Appraisal Basis | Based on the home’s current ‘as-is’ market value. | Based on the home’s projected ‘as-completed’ value – what the home will be worth after all renovations are finished. |

| Process Complexity | More straightforward, fewer moving parts. | More complex, involving detailed renovation plans, contractor bids, escrow accounts for funds, and multiple inspections. Can take longer to close. |

| Contractor Requirement | Not applicable for the loan itself. | Requires the use of VA-approved, licensed, and insured contractors for all renovation work; no DIY allowed. |

| Renovation Scope | None. | Limited to repairs that improve safety, soundness, sanitation, and habitability; luxury upgrades are typically not permitted. |

| Timeline for Completion | N/A | Repairs must generally be completed within 90-120 days after the loan closes. |

Key Requirements for a VA Home Loan for Fixer Upper

To use your VA loan for a fixer-upper, you must follow specific guidelines:

- VA Loan Eligibility: You must meet standard VA loan eligibility requirements, including service minimums, and obtain a Certificate of Eligibility (COE) to prove your entitlement.

- Primary Residence Only: The loan is strictly for your primary residence, not a second home, vacation property, or investment property.

- Loan Limits: While the VA has no loan limit for those with full entitlement, lenders often cap renovation financing. These caps typically range from $35,000 to $50,000. Discuss these limits with your lender.

- Renovation Timeline: All work must be completed within a firm 90-120 day timeline after closing, requiring careful planning with your contractor.

- VA-Approved Contractors: A critical rule: renovations must be done by a licensed, bonded, and insured VA-approved contractor. DIY work, or “sweat equity,” is not permitted, as the VA requires professionals to ensure quality and safety.

- Credit Score: The VA doesn’t set a minimum credit score, but lenders do. Many require a score of 580 or higher, though some may ask for 620+.

What Renovations Qualify?

A VA home loan for fixer upper is meant to bring a property up to the VA’s Minimum Property Requirements (MPRs) for safety and livability. Therefore, qualified renovations focus on essential repairs, not luxury upgrades.

Here’s a breakdown of what’s generally allowed and what’s typically not:

Allowed Improvements (Focus on safety, functionality, and habitability):

- Structural Repairs: Replacing a faulty roof, repairing foundations, addressing structural damage.

- System Upgrades: Installing new HVAC, updating electrical wiring, repairing or replacing plumbing, installing new water heaters.

- Safety & Health: Treating mold or lead paint, removing asbestos, addressing pest infestations.

- Weatherization: Installing new windows and doors, improving insulation.

- Interior Updates (non-luxury): Repairing/replacing flooring, painting (for health hazards), and basic kitchen/bath remodels that improve function and safety (e.g., fixing leaks, replacing broken fixtures).

- Accessibility Updates: Making modifications for veterans with disabilities.

Disallowed Improvements (Typically considered luxury, non-essential, or major structural additions):

- Major Structural Additions: Adding rooms, a second story, or anything that significantly alters the home’s footprint.

- Luxury Upgrades: Installing a swimming pool, building an outdoor kitchen, adding elaborate landscaping.

- Detached Structures: Building a new detached garage, shed, or guest house.

- Cosmetic Only: Purely aesthetic changes are disallowed unless part of a larger project that improves safety and habitability and is typical for the area.

The key is that repairs must improve safety and habitability and be typical for the community. Major structural work or non-essential additions are usually off-limits.

The Step-by-Step Guide to Your VA-Funded Renovation

Using a VA home loan for fixer upper can seem overwhelming, but breaking it into steps makes it manageable. Think of it as building your dream home one milestone at a time.

Success depends on having the right team: a VA-savvy real estate agent, an experienced renovation lender, and a contractor who knows VA requirements. Proper planning ensures a smooth journey.

Step 1: Confirm Eligibility and Get Pre-Approved

Before house hunting, you need to understand your qualifications and buying power.

Your Certificate of Eligibility (COE) is essential. If you don’t have one, apply for your COE on the eBenefits site. This free document proves your entitlement to lenders.

Finding a VA renovation lender can be tricky, as not all offer these complex loans. Shop for lenders experienced with VA home loan for fixer upper projects.

For pre-approval, gather your financial documents (pay stubs, tax returns, etc.). Your lender will determine your maximum loan amount for purchase and renovation, giving you a realistic budget and making you a serious buyer.

Don’t forget to gather all the documentation needed upfront to prevent delays.

Step 2: Find a Property and a VA-Registered Contractor

House hunting for a fixer-upper requires a different mindset. Look for properties with solid bones but issues that fall within VA-approved renovation guidelines.

Identifying potential in a property takes practice. Look for homes where major systems are sound, but things like HVAC, plumbing, or finishes need updating. Your real estate agent can be invaluable here.

Contractor selection is critical and should happen early. The VA requires licensed, bonded, and insured professionals. You can find a VA-approved contractor via the VA’s database, but be sure to vet them.

Interview several contractors, asking for references from past VA projects. The right one will understand VA rules, provide detailed bids and plans, and help develop a comprehensive scope of work.

This contractor relationship is crucial because they’ll work directly with your lender and the VA.

Step 3: The Appraisal and Loan Closing

The appraisal for a VA home loan for fixer upper is different from a standard purchase.

The VA appraiser conducts an ‘as-completed’ appraisal, evaluating the property’s future worth based on your contractor’s detailed renovation plans.

The resulting Notice of Value (NOV) is crucial. It sets the maximum loan amount based on the projected value and lists any required repairs to meet Minimum Property Requirements.

The closing process will likely take longer than a traditional VA loan. The VA funding fee still applies, helping to keep this program available for future veterans.

After closing, renovation funds are held in an escrow account and released to your contractor in stages as work is completed and inspected.

Step 4: Managing the Renovation Project

Once you’re a homeowner, good project management is key to a smooth renovation.

Sticking to the timeline is non-negotiable. You have 90-120 days to complete all work. Work with your contractor to create a realistic schedule.

The draw schedule releases funds from escrow in stages as milestones are met. This protects you and the lender by ensuring work is completed before payment.

Progress inspections occur throughout the project to verify work meets VA standards and stays on track.

The final VA inspection is your finish line. An inspector will verify that the property now meets all Minimum Property Requirements and work was completed as planned.

Handling cost overruns requires a contingency fund. Budget an extra 10-15% for unexpected issues common in older homes. This buffer prevents out-of-pocket expenses that could derail your project.

Unexpected finds during renovation are normal. The key is staying flexible while keeping your eye on the prize—a beautifully renovated home customized to your needs.

Weighing the Pros, Cons, and Considerations

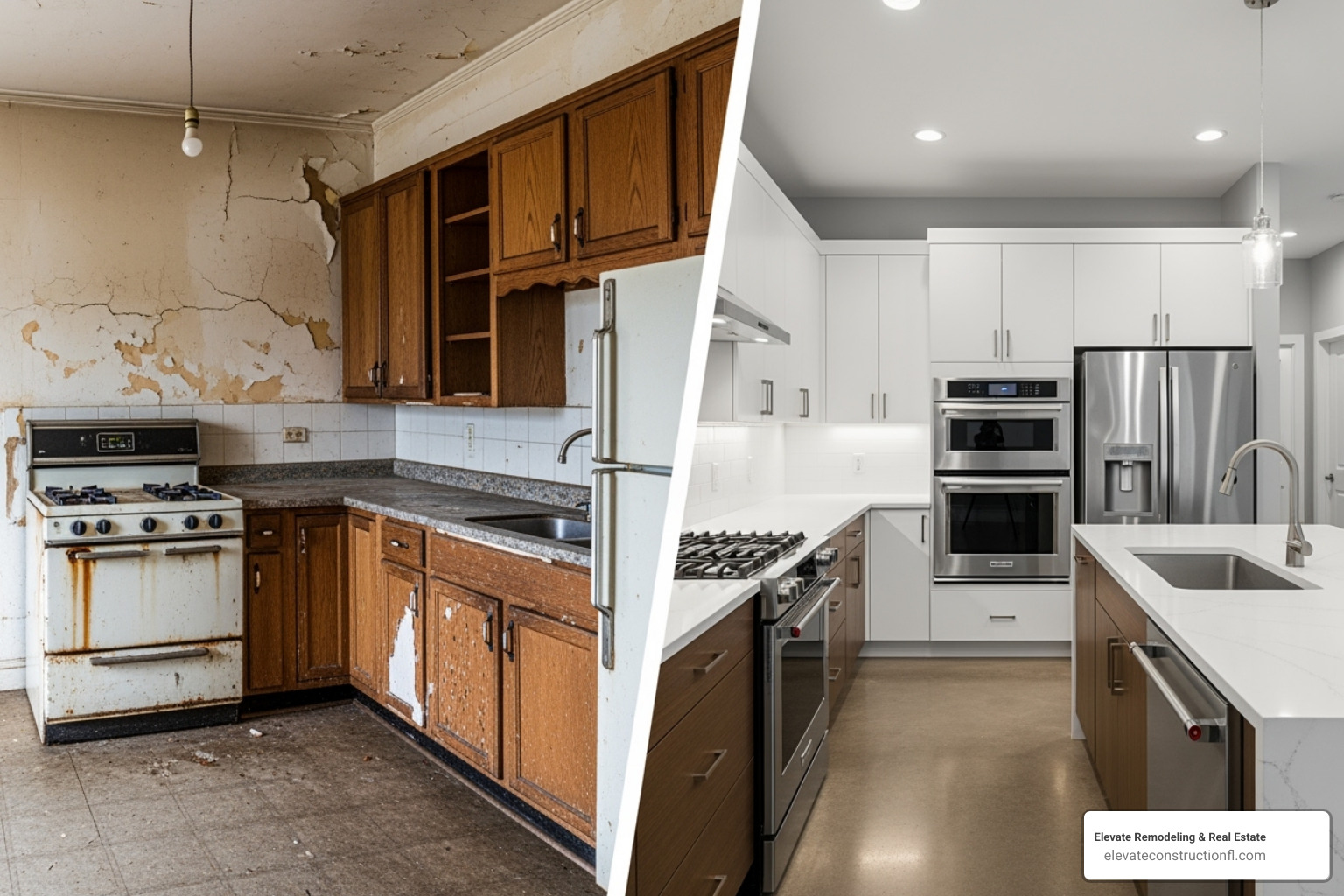

Choosing a VA home loan for fixer upper is a big decision. It’s like adopting a rescue pet—it requires extra care, but the reward can be wonderful.

To make the right choice, you must understand what’s involved. This loan is rewarding but complex, more like restoring a classic car than buying a new one.

Pros and Cons of Using a VA Home Loan for Fixer Upper

The beauty of this loan is turning problems into opportunities. A house needing a new roof could be your ticket into a neighborhood you thought was unaffordable.

The biggest advantages are the 0% down payment and no mortgage insurance. While others save for a down payment, you can move forward with just closing costs, saving money every month.

You’re also building instant equity. Buying a home for $200,000 and investing $30,000 in renovations can result in a property worth $250,000 or more, giving you an immediate financial boost.

The customization factor is huge. You get to create exactly what you want from the beginning, reflecting your style and needs.

However, there are challenges. Finding a lender for these specialized loans can be difficult, and the process often takes longer than a traditional closing.

The contractor requirements can be frustrating for handy homeowners. All work must be done by VA-approved professionals, which can mean higher costs and less control.

The limited renovation scope might clash with your vision. Luxury upgrades like pools or outdoor kitchens are typically disallowed, as the focus is on safety and livability.

Timeline pressure is another reality check. The 90-120 day completion window is a firm deadline, and unexpected issues can cause delays.

And remember, this benefit is strictly for your primary residence. You can’t use it to flip houses or build a rental portfolio.

The bottom line: A VA home loan for fixer upper is an incredible tool if you’re comfortable with complexity and the renovation process. If you prefer simplicity, a traditional VA loan might be better.

At Elevate Remodeling & Real Estate, we’ve seen veterans use these loans to transform properties into dream homes. The key is having realistic expectations and a solid team.

Frequently Asked Questions about VA Fixer-Upper Loans

When you’re considering a VA home loan for fixer upper project, it’s natural to have questions. These are the questions that come up most often.

Can I do the renovation work myself to save money?

This is a common question, but the answer is no. VA renovation loans require all work to be done by a licensed, VA-registered third-party contractor. You cannot do the work yourself.

This is known as “sweat equity,” which is not permitted. The VA requires licensed contractors to ensure repairs meet safety standards and are completed on time, protecting both you and their investment.

What happens if the renovations cost more than the original estimate?

Renovation projects often have surprises, like hidden plumbing or electrical issues. This is why a contingency reserve is so important.

Most VA home loan for fixer upper projects include a 10-15% contingency fund to handle unexpected issues during construction.

For example, on a $30,000 renovation, a $4,500 contingency can cover unexpected repairs. If costs exceed the estimate and contingency, you must pay the difference out-of-pocket. This is why choosing an experienced contractor with realistic estimates is crucial.

How is the loan amount determined for a VA renovation loan?

The loan amount calculation for a VA home loan for fixer upper is straightforward but important to understand.

Your total loan amount is the lesser of two figures: 1) the purchase price plus renovation costs, or 2) the ‘as-completed’ appraised value (what the home will be worth after repairs).

For example, if you buy a home for $200,000 with $35,000 in repairs (totaling $235,000) and it appraises for $250,000, you can finance the full $235,000. If it only appraises for $220,000, your loan is capped at that amount, and you must cover the $15,000 difference or reduce your renovation scope.

This system protects you and the lender by ensuring you don’t borrow more than the home’s future value. An early, realistic appraisal is key for budget planning.

Conclusion: Turn Your Vision into Your Home

Your military service earned you the incredible benefit of buying and renovating a home with zero money down. A VA home loan for fixer upper isn’t just financing; it’s a tool to turn your vision into reality, even if a home needs work.

While others compete for move-in-ready homes, you can access properties with overlooked potential. You can build instant equity, customize your space, and avoid private mortgage insurance.

The process requires patience, working with VA-approved contractors, and sticking to timelines and essential improvements. For many, this is a small price for the opportunity to create a dream home and build wealth.

Success depends on having the right team of professionals who understand the construction and real estate complexities of these loans. You need partners to guide you through contractor selection, property identification, and project management.

For veterans in the Tampa Bay area, partnering with a team that understands both real estate and construction is key. At Elevate Remodeling & Real Estate, we offer an all-in-one solution combining remodeling expertise, real estate services, and funding guidance. Our team knows how to steer VA renovation loan requirements while delivering the high-quality projects you deserve.

Your service has earned you this benefit. Now it’s time to create the home you’ve always wanted. Start your home renovation journey today and see how a fixer-upper can become your family’s forever home.